Make a Difference with Your Tax Credit Donation

Posted in: Uncategorized

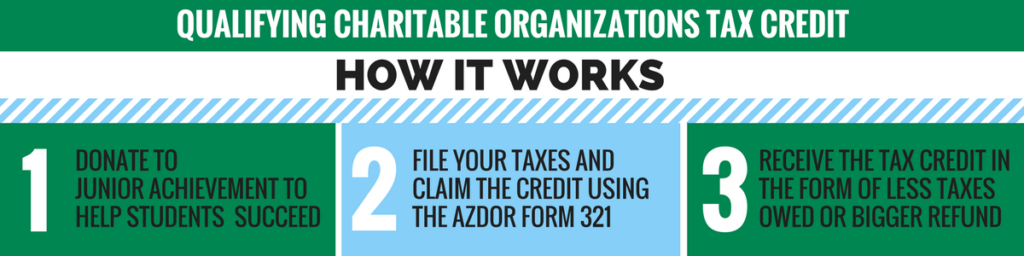

Did you know: donations to Junior Achievement of Arizona qualify for a dollar-for-dollar AZ charitable tax credit, up to $400/person! And, it does not compete with school tax credits!

When you direct your Charitable Tax Credit donation to Junior Achievement, you are:

- Preparing Arizona students to succeed in work and life.

- Unleashing the potential in our kids and changing who they will become.

- Helping ensure a more robust and sustainable future for Arizona.

Your tax credit donation makes it possible for 12 AZ students to receive our programs this year. Hear what some of our students had to say when they went through JA BizTown:

Make a tax credit donation now

Junior Achievement of Arizona is certified as a Qualifying Charitable Organizations (use QCO Code: 20937 on your AZDOR Form 321). Here are some frequently asked questions. Please consult your tax professional for advice about your specific tax situation.